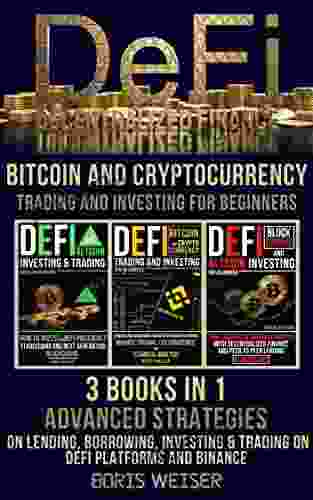

Advanced Strategies for Lending, Borrowing, Investing, and Trading on DeFi Platforms

Decentralized finance (DeFi) has emerged as a revolutionary force in the financial world, offering unprecedented opportunities for lending, borrowing, investing, and trading. DeFi platforms leverage blockchain technology to empower individuals with greater control over their finances, eliminating the need for intermediaries and unlocking a world of possibilities.

This comprehensive guide will delve into the intricacies of DeFi, providing you with advanced strategies to maximize your returns and navigate the complexities of this rapidly evolving ecosystem. Whether you're a seasoned DeFi enthusiast or a newcomer seeking to unlock the potential of decentralized finance, this guide will equip you with the knowledge and tools you need to succeed.

DeFi platforms have revolutionized the traditional lending and borrowing landscape, offering attractive interest rates and flexible terms. By lending your assets, you can generate passive income, while borrowing allows you to access capital without the need for collateral.

4.5 out of 5

| Language | : | English |

| File size | : | 3473 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 293 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |

- Yield Farming: Participate in yield farming by lending your assets to liquidity pools, which are then used by traders to facilitate trades. This strategy can generate significant returns, but it also carries higher risk due to the volatility of cryptocurrencies.

- Flash Loans: Utilize flash loans to borrow assets instantly and execute complex trading strategies. These loans are short-term and must be repaid within the same transaction, providing opportunities for arbitrage and leverage.

- Collateralized Lending: Secure loans against your crypto assets to access capital at lower interest rates. This strategy is ideal for those who want to maintain ownership of their assets while accessing liquidity.

- Margin Trading: Leverage your borrowed funds to amplify your trading profits. However, this strategy carries significant risk and should be used with caution.

- Short Selling: Borrow assets you believe will depreciate in value and sell them immediately. If the price falls as expected, you can buy back the assets at a lower price and repay your loan, pocketing the difference.

- Hedging: Use borrowed assets to reduce the risk of your existing positions. By taking opposite positions, you can offset potential losses and protect your portfolio.

DeFi platforms offer a wide range of investment opportunities, allowing you to diversify your portfolio and access innovative financial instruments.

- Liquidity Pool Investing: Provide liquidity to decentralized exchanges by depositing your assets into liquidity pools. In return, you earn a portion of the trading fees generated on the platform.

- Index Funds: Invest in diversified baskets of DeFi assets, similar to traditional index funds. This strategy provides exposure to a broad range of tokens and reduces the risk associated with investing in individual assets.

- Tokenomics Analysis: Study the tokenomics of DeFi projects to identify tokens with strong value propositions and growth potential. This involves evaluating token allocation, vesting schedules, and use cases.

DeFi platforms enable seamless trading of cryptocurrencies, providing access to decentralized exchanges and advanced trading tools.

- Scalping: Execute high-frequency trades to capitalize on small price movements. This strategy requires a deep understanding of market trends and technical analysis.

- Swing Trading: Hold assets for a medium-term period, typically days or weeks, to capture larger price fluctuations. This strategy involves identifying trends and entering and exiting positions at key support and resistance levels.

- Automated Trading: Use trading bots to execute trades automatically based on predefined parameters. This strategy can save time and reduce the risk of emotional decision-making.

While DeFi offers immense opportunities, it also comes with its share of complexities. Understanding the risks and adopting best practices is crucial for safeguarding your assets.

- Smart Contract Risk: Smart contracts are automated agreements that govern transactions on DeFi platforms. Ensure that you thoroughly understand the terms of any smart contract before interacting with it.

- Impermanent Loss: Liquidity providers in liquidity pools can experience impermanent loss if the prices of the deposited assets diverge significantly.

- Cybersecurity Threats: DeFi platforms are potential targets for hackers. Implement robust security measures, including using strong passwords and storing your assets in secure wallets.

The world of DeFi is constantly evolving, presenting both opportunities and challenges. By embracing advanced strategies and navigating the complexities of this ecosystem, you can unlock the full potential of decentralized finance. Remember to conduct thorough research, manage risk prudently, and seek professional guidance when necessary.

With the knowledge and strategies outlined in this guide, you are equipped to succeed in the exciting world of DeFi. Join the financial revolution and experience the transformative power of decentralized finance.

4.5 out of 5

| Language | : | English |

| File size | : | 3473 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 293 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Arnaldo Momigliano

Arnaldo Momigliano Erik Didriksen

Erik Didriksen Rajendra Ramlogan

Rajendra Ramlogan Lois Holzman

Lois Holzman Ray Tutaj

Ray Tutaj Aileen Moreton Robinson

Aileen Moreton Robinson Tara Cousineau Phd

Tara Cousineau Phd Valma Shakti

Valma Shakti Phyl Newbeck

Phyl Newbeck Susannah Crockford

Susannah Crockford Deane Walter

Deane Walter Scott Todnem

Scott Todnem Vickie Sunnel

Vickie Sunnel Germinal G Van

Germinal G Van Jack W Gregory

Jack W Gregory Steven Hawthorne

Steven Hawthorne Ashutosh R Nandeshwar

Ashutosh R Nandeshwar Martin Loughlin

Martin Loughlin Holly Zurich

Holly Zurich Wayne Olson

Wayne Olson

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Logan CoxFollow ·15.7k

Logan CoxFollow ·15.7k Jace MitchellFollow ·7.8k

Jace MitchellFollow ·7.8k Neal WardFollow ·10.8k

Neal WardFollow ·10.8k Charlie ScottFollow ·4.5k

Charlie ScottFollow ·4.5k Spencer PowellFollow ·4.8k

Spencer PowellFollow ·4.8k Leslie CarterFollow ·18.6k

Leslie CarterFollow ·18.6k Isaias BlairFollow ·16k

Isaias BlairFollow ·16k Joseph ConradFollow ·4.8k

Joseph ConradFollow ·4.8k

H.G. Wells

H.G. WellsVisual Diagnosis and Care of the Patient with Special...

A Comprehensive Guide for Healthcare...

Joshua Reed

Joshua ReedPractical Guide Towards Managing Your Emotions And...

In today's...

Will Ward

Will WardYour Eyesight Matters: The Complete Guide to Eye Exams

Your eyesight is one of your most precious...

Fabian Mitchell

Fabian MitchellManual For Draft Age Immigrants To Canada: Your Essential...

Embark on Your Canadian Dream with Confidence ...

Jay Simmons

Jay SimmonsThe Ultimate Guide to Reality TV: Routledge Television...

Reality TV has...

Nick Turner

Nick TurnerAn Idea To Go On Red Planet: Embarking on an...

Journey to the...

4.5 out of 5

| Language | : | English |

| File size | : | 3473 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 293 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |