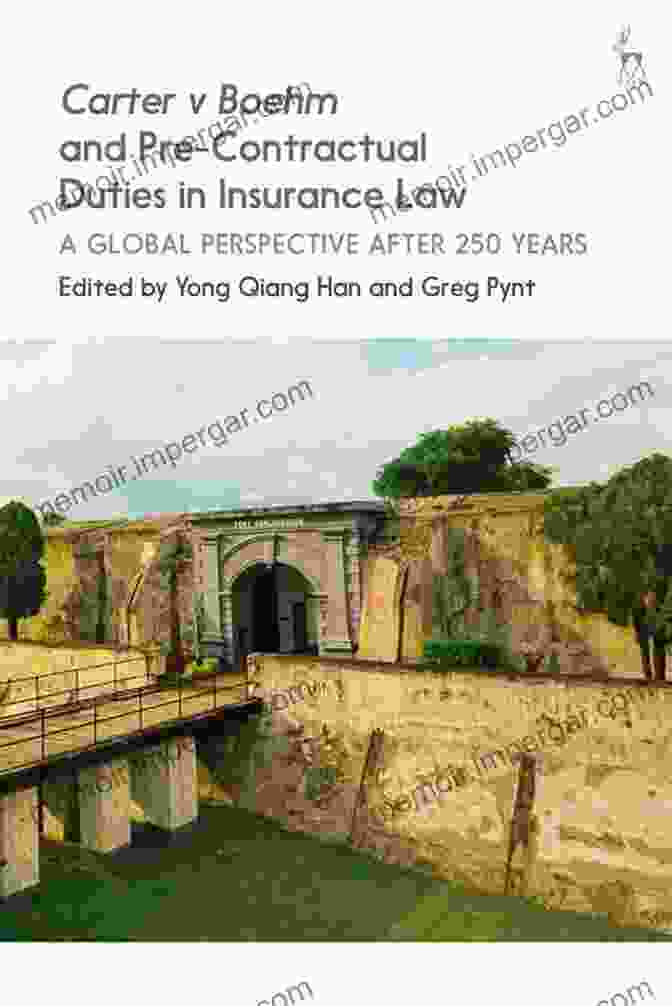

Carter Boehm and Pre-Contractual Duties in Insurance Law: A Comprehensive Analysis

5 out of 5

| Language | : | English |

| File size | : | 1143 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 793 pages |

The insurance industry is built upon the principle of utmost good faith, requiring both insurers and policyholders to act with honesty and transparency throughout the life of the insurance contract. This duty of utmost good faith extends beyond the inception of the contract, shaping the pre-contractual phase as well. The landmark case of Carter Boehm v. Agents of the British Marine Insurance Company (1766) established the foundational principles governing pre-contractual duties in insurance law.

Carter Boehm: A Defining Case

In Carter Boehm, a merchant seeking insurance for his ship failed to disclose to the insurer that the ship was old and had encountered previous damage. After the ship sank, the insurer refused to pay the claim, arguing that the merchant had breached his duty of utmost good faith by withholding material information. The court ruled in favor of the insurer, establishing the principle that both parties to an insurance contract have a duty to disclose all material facts that could influence the insurer's assessment of risk.

The Principle of Utmost Good Faith

The principle of utmost good faith plays a pivotal role in pre-contractual duties in insurance law. Insurers rely on accurate and complete information from policyholders to assess the risk and determine appropriate insurance terms. Policyholders, in turn, have the responsibility to provide all material information that could potentially affect the insurer's decision-making process.

Material Facts: Disclosure vs. Non-Disclosure

Material facts are those that would reasonably influence the insurer's decision to enter into the contract or the terms of the contract itself. The duty of disclosure extends to both known and reasonably knowable facts. Failure to disclose material facts can have serious consequences, including the voidance of the insurance contract or denial of claims.

Consequences of Non-Disclosure

The consequences of non-disclosure of material facts can be severe. Insurers may have the right to rescind the insurance contract, meaning it is considered void from the outset. Additionally, insurers can deny claims made under the policy if they can prove that the policyholder intentionally or negligently withheld material information.

Exceptions to the Duty of Disclosure

In certain circumstances, there may be exceptions to the duty of disclosure. These exceptions include:

- Mutual knowledge: If both parties are aware of the material fact, disclosure is not required.

- Immateriality: If the material fact is unlikely to influence the insurer's assessment of risk, disclosure is not required.

- Waiver: If the insurer expressly or impliedly waives the duty of disclosure, the policyholder is not obligated to disclose the material fact.

Modern Applications and Significance

The principles established in Carter Boehm continue to shape pre-contractual duties in insurance law today. Insurers have a duty to ask clear and specific questions to elicit material information from policyholders. Policyholders must provide accurate and complete answers to all questions and disclose any material facts that could influence the insurer's decision-making.

Carter Boehm v. Agents of the British Marine Insurance Company stands as a landmark case that laid the groundwork for pre-contractual duties in insurance law. The principle of utmost good faith requires both insurers and policyholders to act with honesty and transparency throughout the entire insurance relationship. Understanding the significance of Carter Boehm empowers insurance professionals and policyholders alike, ensuring fair and equitable outcomes in the insurance industry.

5 out of 5

| Language | : | English |

| File size | : | 1143 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 793 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Leslie Davenport

Leslie Davenport Abhishek Kumar

Abhishek Kumar Karissa Tunis

Karissa Tunis Orr Kelly

Orr Kelly Beatriz Robles

Beatriz Robles Kimberly Willis

Kimberly Willis Samuele Resca

Samuele Resca Virginia Reynolds

Virginia Reynolds Eric Herrera

Eric Herrera Mark Jodoin

Mark Jodoin Claude H Yoder

Claude H Yoder Sam Radding

Sam Radding Elizabeth Wright

Elizabeth Wright Walter M Goldberg

Walter M Goldberg Shane Svorec

Shane Svorec Mark Zuehlke

Mark Zuehlke Walter Russell

Walter Russell Ann Gravells

Ann Gravells Brad Acevedo

Brad Acevedo Jonathan Hancock

Jonathan Hancock

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Ivan CoxFollow ·11.6k

Ivan CoxFollow ·11.6k Esteban CoxFollow ·16.7k

Esteban CoxFollow ·16.7k Efrain PowellFollow ·16.2k

Efrain PowellFollow ·16.2k William FaulknerFollow ·11k

William FaulknerFollow ·11k Dan BellFollow ·9k

Dan BellFollow ·9k Jake CarterFollow ·7.2k

Jake CarterFollow ·7.2k Mario BenedettiFollow ·7.9k

Mario BenedettiFollow ·7.9k Billy PetersonFollow ·4.8k

Billy PetersonFollow ·4.8k

H.G. Wells

H.G. WellsVisual Diagnosis and Care of the Patient with Special...

A Comprehensive Guide for Healthcare...

Joshua Reed

Joshua ReedPractical Guide Towards Managing Your Emotions And...

In today's...

Will Ward

Will WardYour Eyesight Matters: The Complete Guide to Eye Exams

Your eyesight is one of your most precious...

Fabian Mitchell

Fabian MitchellManual For Draft Age Immigrants To Canada: Your Essential...

Embark on Your Canadian Dream with Confidence ...

Jay Simmons

Jay SimmonsThe Ultimate Guide to Reality TV: Routledge Television...

Reality TV has...

Nick Turner

Nick TurnerAn Idea To Go On Red Planet: Embarking on an...

Journey to the...

5 out of 5

| Language | : | English |

| File size | : | 1143 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 793 pages |